Some Of Summitpath Llp

Table of ContentsNot known Details About Summitpath Llp Summitpath Llp Things To Know Before You BuySome Of Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is Talking About

Most recently, released the CAS 2.0 Practice Development Training Program. https://www.easel.ly/browserEasel/14593898. The multi-step mentoring program consists of: Pre-coaching positioning Interactive group sessions Roundtable conversations Embellished mentoring Action-oriented mini intends Firms aiming to increase into advising services can additionally transform to Thomson Reuters Method Onward. This market-proven method provides content, devices, and advice for companies curious about advisory servicesWhile the adjustments have unlocked a number of growth opportunities, they have also resulted in obstacles and concerns that today's companies need to have on their radars., companies have to have the capacity to quickly and effectively carry out tax research and boost tax coverage efficiencies.

In enhancement, the new disclosures might lead to an increase in non-GAAP actions, historically an issue that is very looked at by the SEC." Accountants have a great deal on their plate from regulatory adjustments, to reimagined company versions, to an increase in customer expectations. Equaling everything can be challenging, but it does not have to be.

Rumored Buzz on Summitpath Llp

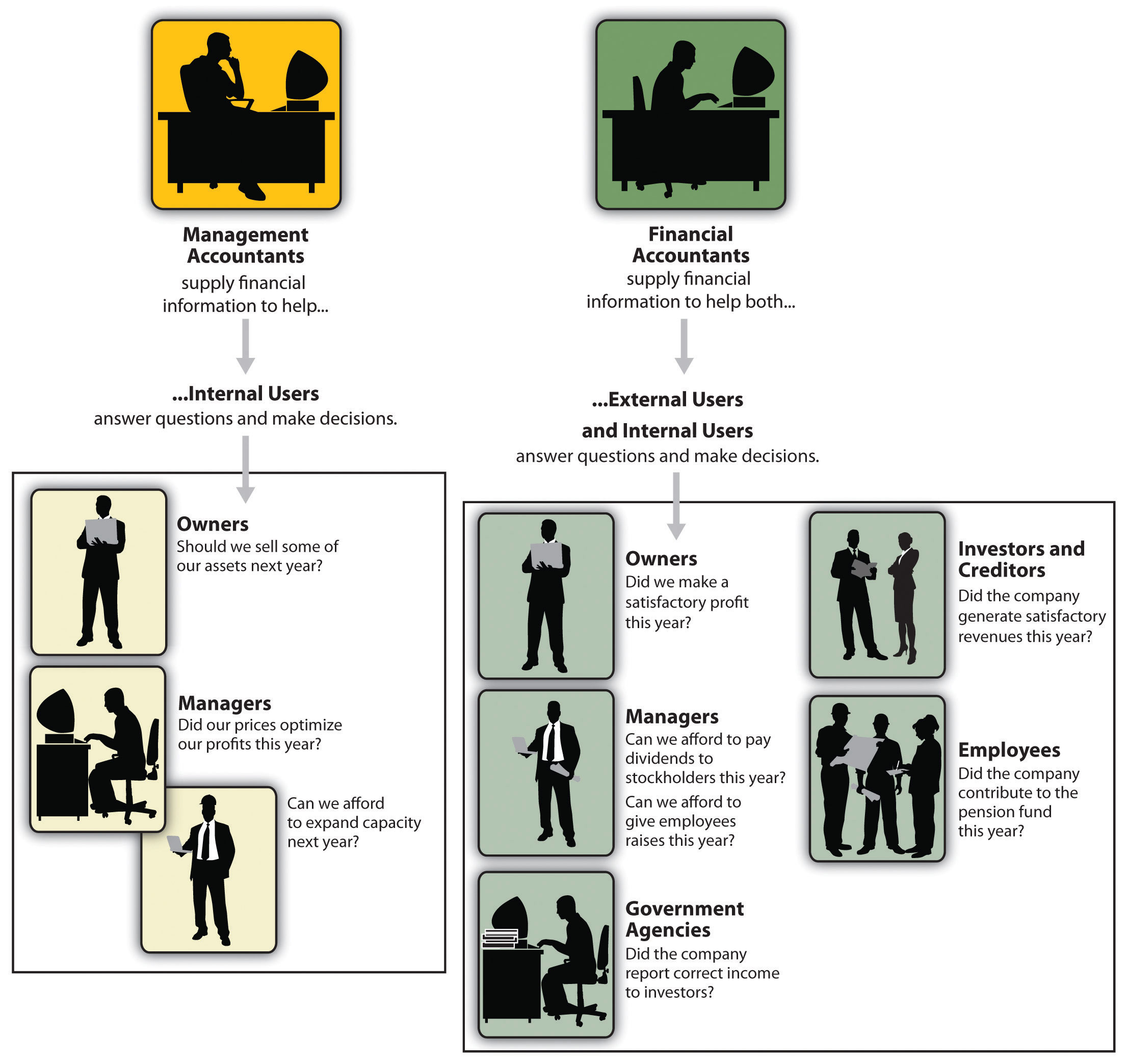

Below, we define four CPA specializeds: taxation, monitoring accountancy, economic reporting, and forensic accountancy. Certified public accountants focusing on taxation assist their customers prepare and file income tax return, decrease their tax obligation worry, and prevent making errors that might cause expensive fines. All CPAs need some knowledge of tax legislation, yet focusing on taxes implies this will certainly be the emphasis of your job.

Forensic accounting professionals typically begin as basic accounting professionals and relocate into forensic accountancy duties gradually. They require solid logical, investigatory, service, and technological accounting abilities. CPAs who specialize in forensic bookkeeping can in some cases relocate up right into administration accounting. CPAs need at least a bachelor's level in accounting or a similar field, and they have to complete 150 credit score hours, consisting of accountancy and business classes.

No states need a graduate level in accounting., bookkeeping, and taxes.

Audit also makes functional sense to me; it's not simply theoretical. The Certified public accountant is a crucial credential to me, and I still obtain proceeding education credits every year to maintain up with our state demands.

Not known Details About Summitpath Llp

As an best site independent expert, I still utilize all the basic foundation of accounting that I learned in university, pursuing my certified public accountant, and operating in public accountancy. Among the points I actually like about bookkeeping is that there are several various work offered. I determined that I intended to begin my occupation in public audit in order to learn a lot in a brief time period and be subjected to various kinds of customers and different locations of accountancy.

"There are some work environments that don't wish to take into consideration someone for a bookkeeping function that is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A certified public accountant is an extremely important credential, and I wished to position myself well in the industry for numerous jobs - Calgary CPA firm. I determined in university as a bookkeeping major that I wished to attempt to obtain my CPA as quickly as I could

I've met lots of excellent accountants who don't have a CERTIFIED PUBLIC ACCOUNTANT, yet in my experience, having the credential actually helps to promote your expertise and makes a difference in your payment and profession alternatives. There are some offices that don't want to consider someone for a bookkeeping duty who is not a CPA.

Summitpath Llp - The Facts

I actually delighted in dealing with numerous kinds of jobs with various clients. I discovered a whole lot from each of my colleagues and clients. I collaborated with many different not-for-profit organizations and found that I have an enthusiasm for mission-driven organizations. In 2021, I determined to take the next step in my accounting occupation journey, and I am currently a self-employed bookkeeping professional and business advisor.

It remains to be a development location for me. One essential high quality in being a successful CPA is genuinely respecting your clients and their businesses. I love collaborating with not-for-profit clients for that really factor I really feel like I'm really adding to their objective by helping them have good monetary details on which to make wise company decisions.